laissez les bon temps rouler

I’m a day early with this post because I’ll be travelling over the weekend for Mardi Gras. I was going to use mal instead of bon since the market was down, but I didn’t want to put any Louisiana voodoo on March. I also didn’t know there was an album called Let the Bad Times Roll by Ph.D. led alt-rock band The Offspring. The more you know.

It was a tough February as the SPY fell 2.8% and Victory Financial fell 2.5% overall. The sector portfolio outperformed with just a 2.2% decline. Since May, SPY is up 16.8% while our sector portfolio is just behind at 16.2%. Defensive companies held up with Consumer Staples and Real Estate both up over 3% while consumer discretionary tumbled almost 9%. Utilities and Real Estate both pulled ahead of SPY. We underweighted Utilities and overweighted Real Estate, so our record remains 4-7.

The overall economy was the big villain for the month as economic performance was weak while inflation remained stubbornly above target. Consumer confidence, expectations, and retail sales were all down while inflation concerns threw water on further Fed cuts. Earnings have been OK, but guidance has been lukewarm overall.

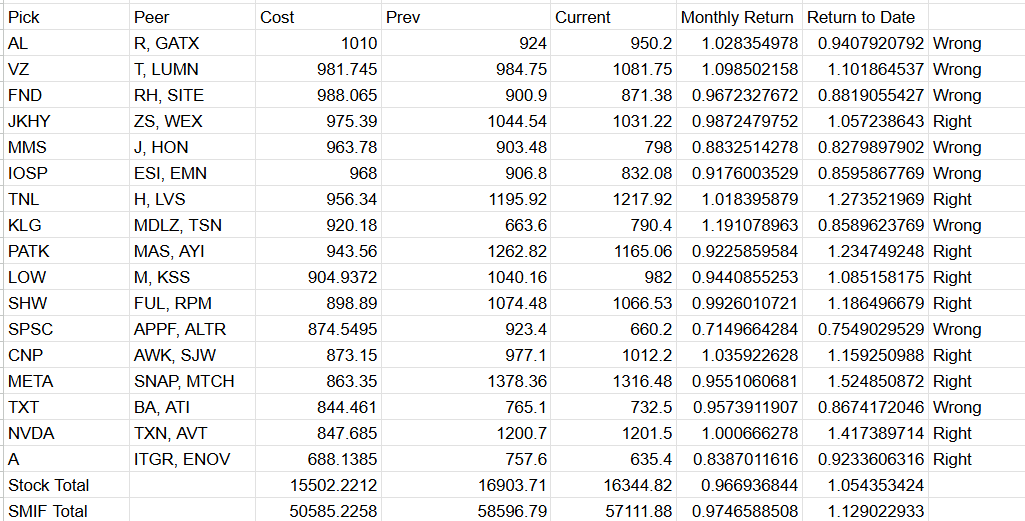

Last month I gave a shout out to Agilent being up 13% for the month and lamented Kellogg’s continued poor performance. This month Agilent dropped 16% while Kellogg’s was up 19%. I have no idea what power this means, but I am definitely lamenting the performance of my lottery tickets. Our individual stocks portfolio was down 3.3% for the month dragging our overall return down to +5.4%. Our record against our peers is still 9-8 with no changes. While Kellogg’s was our best performer, SPS Communications was our worst falling 28.5% for the month.