The market has boomed over the past two years largely on the prospect of benefits from AI. Then this week there was a major announcement of a cheaper, more efficient AI. So what did the market do? Down big with Nvidia falling over 15% in one day (that’s over $500B in lost value). What’s the problem? Well for one it was a Chinese company announcing the breakthrough and there are some questions about the accuracy of the reports. Then there is Jevons paradox which says that making something more efficient (so you would need less of it) will actually result in more of it being used. A common example would be green energy. If green energy becomes more efficient, then it will take share from competing sources like coal. It doesn’t really seem like a paradox to me. That is the pro AI argument, but there is another side. Maybe AI doesn’t need super, duper chips and entire power plants to get the job done. Maybe AI itself isn’t really that great and the massive capital expenditures (going to Nvidia) aren’t going to pay off. The marginal improvement in AI seems to be declining with one theory being that the amount of material used to train the models are running out. Sure there is still a lot of material out there, but are ancient Greek texts really appropriate for training material? Or modern teen texts? Sus. And that doesn’t even mention the Fed holding interest rates steady in their on going battle with inflation, potential tariffs and trade wars with our major trading partners, deportations (and even more immigrants leaving voluntarily), and the deadliest plane crash in the US in decades.

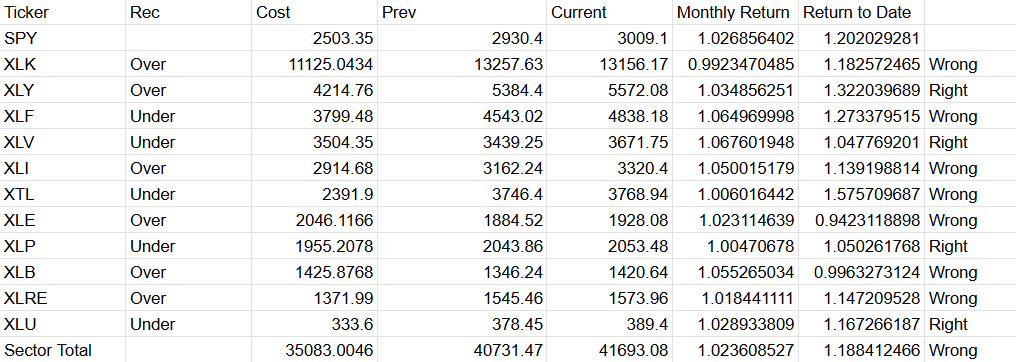

With all of that as backdrop, the market was still up 2.7% for the month. A good January usually bodes well for the year. I am still bearish based on extremely high valuations, but HODL. Victory Financial was up 2.5% for the month with our sector portfolio up 2.4% and our individual stocks up 2.9%. Financials and Healthcare were the strongest sectors up over 6% each while technology was the only down sector for the month. Our record dropped back down to 4-7 as Technology fell back behind the market.

Among the individual stocks, Meta was up 17.7% for the month to take over Nvidia (down 10.6%) as our best performing stock. Patrick rose 16.9%, but I wanted to give a shout out to dear sweet Agilent. It is one of only two stocks that we carried over from last year where it beat its peers despite a meager 2% gain. It had been down 2% so far this year before rising 12.8% for the month and pull ahead of its new peers. This brought our overall record back up to 9-8. Now if only there was something we could do about Kellogg’s.

As a reminder, the Super Bowl is coming up next weekend. For a long time, the super bowl was actually a good predictor of the stock market with the market performing much better after NFC wins as opposed to AFC wins (or original NFL teams vs. others). It was always used as an example of spurious correlation along with hem lines and lipstick and has actually performed very poorly over the past ten years. We’ve had great performance the past two years following Chiefs victories. When the Eagles won in 2018, the market was down. Just sayin’.